nh meals tax rate

Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85. Chris Sununu in this years budget package which passed state government in June.

Nh Where Rich Towns Like Rye Get Richer And Poor Ones Like Berlin Need Help Indepthnh Orgindepthnh Org

To ensure a smooth transition to the new tax rate we are reminding operators and taxpayers alike of this change.

. The Meals and Rooms Tax is assessed to customers of hotels restaurants or other businesses providing taxable meals room rentals and motor vehicle rentals. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety. This budget helps small businesses by reducing the Business Enterprise Tax BET from 06 to 055.

New Hampshires meals and rooms tax decreases 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Starting October 1 2021 the New Hampshire Department of Revenue Administration NHDRA is decreasing the states Meals and Rooms Rentals Tax rate from 9 to 85. Village Tax Rates Excel Cooperative School District Apportionments All PDF County Apportionments All State Education Property Tax Warrant Summary Report State Education Property Tax Warrant Summary Report State Education Property Tax Warrant All Municipalities 2020.

The rate is reduced to 875 beginning on or after October 1 2021. Concord NH The. 1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting.

Concord NH The New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and Rooms Rentals Tax rate will decrease by 05 from 9 to 85. There are some other business tax changes as well. Increasing the percentage returned to towns means that even with the reduced rate towns will see an increase in the MR tax distribution.

The tax is assessed upon patrons of hotels and restaurants on certain rentals and upon meals costing 36 or more. Exact tax amount may vary for different items. Advertisement Its a change that was proposed by Gov.

Many municipalities exempt or charge special sales tax rates to certain types of transactions. New Hampshire is one of the few states with no statewide sales tax. The tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants as well as on motor vehicle rentals.

2022 New Hampshire state sales tax. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Tax Rates PDF Tax Rates Excel Village Tax Rates PDF Village Tax Rates Excel.

Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the customer receipt or check. Getty Images New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. The meals and rooms tax reduction was set in motion by a two-year budget signed by Gov.

The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations. Exeter New Hampshire Sales Tax Exemptions. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

Multiply this amount by 09 9 and enter the result on Line 2. Prepared Food is subject to special sales tax rates under New Hampshire law. Years ending on or after December 31 2026 NH ID rate is 2.

The Meals and Rentals MR Tax was enacted in 1967. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Cut to meals and rooms tax to take effect on Friday.

Reducing our MR tax rate makes New Hampshire marginally more competitive with Maine and Vermont both of which have a 9 lodging tax. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered.

This budget helps consumers by reducing the Meals and Rooms Tax from 9 to 85 its lowest level in over a decade. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where meals are served the holder of the license. A 9 tax is also assessed on motor vehicle rentals.

Federal excise tax rates on beer wine and liquor are as follows. The state meals and rooms tax is dropping from 9 to 85. It would also decrease the BET from 06 to 055 this year and then 05 the next.

1800 per 31-gallon barrel or 005 per 12-oz can. A proof gallon is a gallon of. New Hampshire is one of the few states with no statewide sales tax.

The current tax on NH Rooms and Meals is currently 9. To ensure a smooth transition to the new tax rate we are reminding. The MR Tax is paid by the consumer and is collected and remitted to the State on the 15th of each month by operators of hotels restaurants or other businesses providing.

In most states essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate. New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and Rooms Rentals Tax ratewill decrease by 05 from 9 to 85. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters.

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Years ending on or after December 31 2027 NH ID rate is 0. 2022 New Hampshire state sales tax.

The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. The meals tax rate is 625.

Chris Sununu in June. It allows a credit for tax overpayments of up to five times the tax liability over five years. Years ending on or after December 31 2025 NH ID rate is 3.

NH Meals and Rooms Tax. The BPT rate would be cut from the current 77 to 76 this year and 75 in 2022. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

107 - 340 per gallon or 021 - 067 per 750ml bottle depending on alcohol content. The State of New Hampshire does not issue Meals Rentals Tax exempt certificates. A 9 tax is also assessed on motor vehicle rentals.

1350 per proof-gallon or 214 per 750ml 80-proof bottle. Chapter 144 Laws of 2009 increased the rate from 8 to the current rate of 9 and added campsites to the definition of hotel. There are however several specific taxes levied on particular services or products.

When A Fee Becomes A Tax Nh Business Review

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Tax Guide

New Hampshire Meals And Rooms Tax Rate Cut Begins

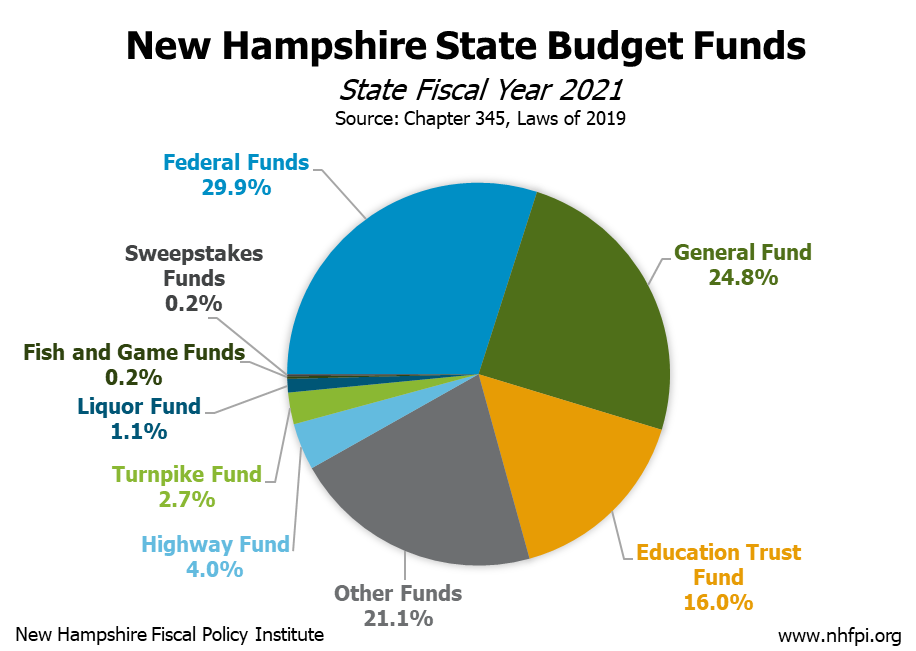

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

New Hampshire S Fiscal Situation Improves With Higher Revenues Underspending Nh Business Review

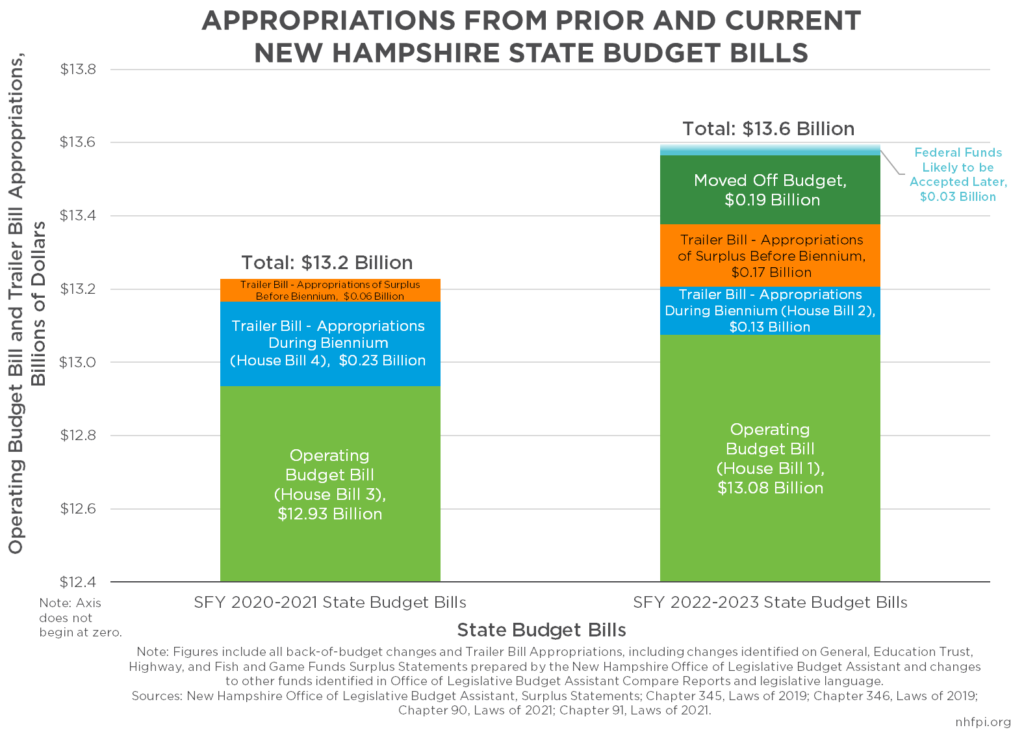

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Transparency Nh Department Of Revenue Administration

Historical New Hampshire Tax Policy Information Ballotpedia

We Used Science And Data To Determine Which U S States Have It Made States In America America States

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

New Hampshire Revenue Dept Launches Final Phase Of Tax System

Hotel Nh Milano Fiera Hotel In Milan Italy Nh Hotels Com

Lake Massasecum Campground Activities Camping Park Lake Park

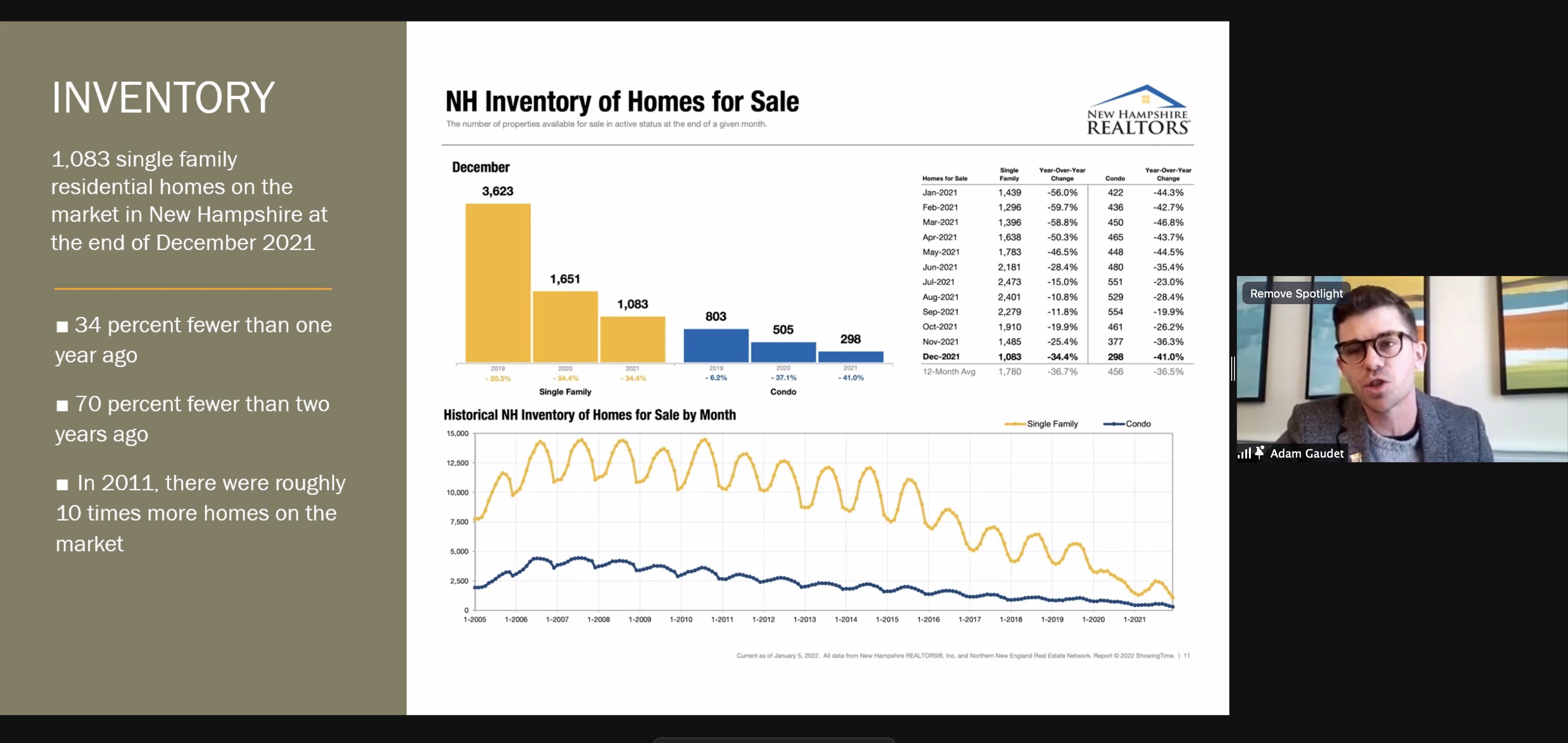

Housing Action Nh Housingactionnh Twitter

The Reserve Bank Of India Rbi Held Its Policy Rate At 7 25 Percent On Tuesday Pausing As Widely Expected After A Spike In Fo Supportive Japanese Yen Hold On

Early Impacts Of The Covid 19 Crisis On State Revenues New Hampshire Fiscal Policy Institute