foreign gift tax uk

Received more than 100000 from a non-resident alien individual or a foreign estate. Learn How EY Can Help.

Inheritance tax will normally be payable on all UK and foreign assets or UK based assets where non-UK domiciled that exceed the nil-rate band.

. 8 August 2016 at 1050AM. This includes foreign persons related to that. Can You Claim Gift Aid On Foreign Donations.

The donor might have to consider UK IHT if the cash he has gifted is within. The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the nonresident alien individual or foreign estatemust exceed 100000 as of 2021. Tesco Double The Difference 2700.

I didnt do it nobody saw me do it you cant prove a thing. There is also a residence nil-rate band. There are no UK taxes or restrictions on gifts from abroad but there may be in the country of origin.

The value of the gifts received from foreign corporations or foreign partnerships must exceed. Your bank may seek information on the source of the funds as part of their anti money laundering procedures. Since 2007 this threshold has increased to 650000 for married couples and civil partners providing the executors transfer the first spousepartners unused inheritance tax.

Reporting the Foreign Gift is a key component to IRS law. Thomson EU26104 Claim 1700. If a UK domiciled individual transfers an asset into a trust there will be an immediate lifetime inheritance tax charge at a rate of 20.

If you are UK domicile and your estate is valued at over 325000 your estate will be subject to inheritance tax - either 40 or 36 on the amount over the threshold. There will be no income tax due on the gifting of money. Person may be subject to Form 3520 penalties which are usually 25.

In respect of the donor from a UK perspective a gift of cash or any other asset other than certain UK assets for example UK real estate will NOT create a CGT liability. In addition gifts from foreign corporations or partnerships are subject to a. And even if the donor dies before.

Ad Consulting and Scalable Services to Help Businesses with Foreign and International Taxes. IHT will only be payable if the value of the asset gifted to the trust exceeds the 325000 nil rate band. One proviso for this reduction in UK inheritance tax is that the donor needs to have survived the gift by a specific period.

However unlike the 15-year requirement in France the period in the UK is seven years. Estate Gift Tax Treaties International US. Then this will need to be declared to the UK for tax purposes.

This charge is calculated on the value of the asset transferred. In this scenario there are no US expat gifts tax reporting requirements in regards to this gift. Visit the United States Income Tax Treaties - A to.

British Airways EU26104 Claim EUR1200. Assuming you inherited Australian dollars rather than sterling you or your son may want to. If it is not reported the US.

A foreign gift does not include amounts paid for qualified tuition or medical payments made on behalf of the US. Payment using foreign income or gains paid into any UK account such as payments for consideration for services provided in the UK that are paid from an offshore account to the service providers UK account are always regarded as a remittance of money or other property part 1 of Condition A under ITA07s809L 2 a. IRS Form 3520 is required if you receive more than 100000 from a nonresident alien or a foreign estate.

The estate tax provisions are located in Article XXIX B of the United States Canada Income Tax Treaty. Person receives a gift from foreign person and the value of gift exceeds either the individual foreign person or entity foreign person threshold the gift must be reported. For donations made by overseas donors who live in the UK to the gift benefit scheme but who continue to pay in-home taxes HMRC provides gift tax credits.

For example an American expat receives a gift in the amount of 90000 from a foreign person. Person a foreign person that the recipient treats as a gift or bequest and excludes from gross income. Hi HMRC Having gone through the various queries posted on the forum here I understand that money received as gift from abroad non-domiciled donor is not taxable in the UK except for.

How Inheritance Tax works. Helping Businesses Navigate Various International Tax Issues. Treaties with estate andor gift tax provisions can be found at the International Bureau of Fiscal Documentations Tax Research Platform.

Therefore the gift in France will result in the donors estate having been reduced for the purposes of UK inheritance tax. Organizations need to identify the donors Billing Address so that they are allowed to claim Gift Aid on these gifts. Such an exemption may carry forward to the next tax year but only for one year.

Basically the disclosure of your foreign gift or inheritance on the Form 3520 is applicable if you. For 2021-2022 the tax-free threshold is 325000. While foreign gift tax may not be due by the donee a foreign person gift does have a disclosure requirement to the IRS if it exceeds certain thresholds.

Find out whether you need to pay UK tax on foreign income - residence and non-dom status tax returns claiming relief if youre taxed twice including certificates of residence. In general a foreign gift or bequest is any amount received from a person other than a US. Foreign Gifts and Bequests.

Thresholds rules and allowances and. Capital Gains Tax. However if you are UK tax resident and you make a capital gain abroad from the sale of a property.

American expatriates are subject to gifts tax reporting requirements on US expat tax returns if the aggregate value of foreign gifts exceeds 100000. The nil-rate band is the amount of an estate on which no inheritance tax is payable in the UK. There is a UK inheritance tax exemption on gifts of 3000 per year 2500 for a grandchild or great-grandchild 5000 for a child or between 1000 and 5000 on wedding gifts.

This assumes he or she is non-UK domiciled as well as non-UK resident. Quidco and Topcashback 4569. Gift 350000 Minus the Inheritance Tax threshold on 27 March 2021 325000 Amount on which tax can be charged 25000 Tax on the gift at 40 25000 X 40 Tax due on the gift must be paid.

If that is the case you will be subject to tax only on overseas income or gains remitted to the UK.

What Are The Consequences Of The New Us International Tax System Tax Policy Center

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

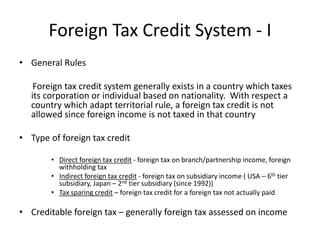

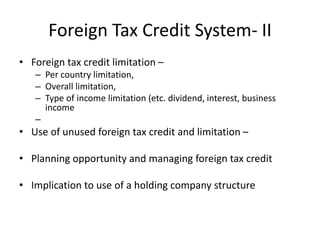

The Foreign Tax Credit International Tax Treaties Compliance

Taxes On Money Transferred From Overseas In The Uk Dns Accountants

Do I Have To Pay Uk Tax On My Foreign Income

How To Increase Affiliate Sales 24 Tips Our Earning Proof Tax Help Sell Your Business Tax Advisor

What Does It Cost To Outsource Your Tax Preparation Tasks Filing Taxes Tax Preparation Tax Return

Pin On Dominca Citizenship By Investment

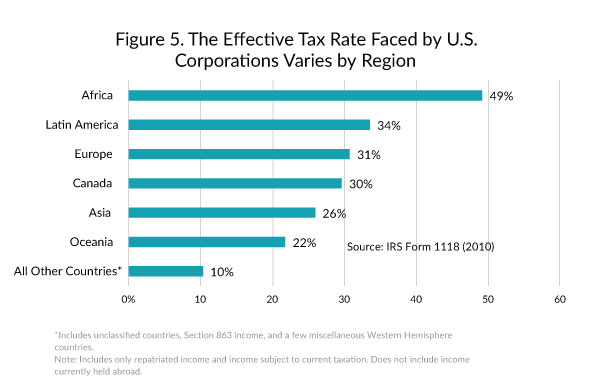

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

Learning From March Madness Why Filing An Extension Could Be Your Sleeper Tax Strategy March Madness March Madness Bracket Learning

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

1882 British India Alwar State Queen Victoria Silver One Rupee Coin Ancient Indian Coins Coins Valuable Coins

What Are The Consequences Of The New Us International Tax System Tax Policy Center